The Eighties Club

The Politics and Pop Culture of the 1980s

|

"Congress in the Dock"

from

Scandal: The Culture of Mistrust in American Politics

Suzanne Garment (New York: Times Books, 1991)

|

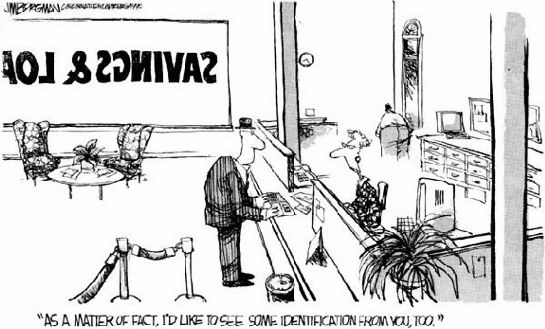

While Congress was virtually swimming in...tawdry and inconclusive scandals, one of the great embarrassments of its history was unfolding. This was of course the savings and loan scandal, which has presented taxpayers with a mind-boggling bill variously estimated at anywhere from $130 billion to $500 billion, the amount it will take to make good on the federal insurance covering thrift institutions that failed during the 1980s. Despite the wishes of political entrepreneurs in both parties, the S&L scandal cannot be traced to a single villain or ideology. Instead, the history of the crisis is a cameo of some of our pronounced and characteristic policy failings of the past quarter century -- a story, as Judge Stanley Sporkin put it in a ruling in a savings and loan case, "that demonstrates the excesses of a misconceived and misapplied regulatory program along with a group of individuals who were bent on exploiting these excesses."

It will be a long time before we get a definitive account of how the crisis came to be, but some of the policy-relevant parts of the story have become clear. The social spending of the 1960s and then the American involvement in Vietnam brought pronounced inflation. This inflation, and in the 1970s the instability surrounding the collapse of the old Bretton Woods system of exchange rate regulation, wreaked havoc with institutions whose success depended on a more stable economic environment.

For instance, our public policies had long encouraged the existence of a group of savings institutions separate from commercial banks and dedicated to providing mortgage money for American homes. These thirft institutions, as they were called, lent money in the form of home mortgages at fixed rates of interest. The thrifts got their profits from the difference between these mortgage rates and the historically lower interest rates that they paid their depositors. But sustained inflation -- and in the early 1980s, ironically, the government's efforts to curb inflation -- sent general interest rates rising steeply. The earnings from the S&Ls' low-interest home mortgage loans were not enough to allow the thrifts to compete for depositors by offering the prevailing high interest rates.

Federal policymakers responded by capping the rates that thrifts and commercial banks could pay depositors. The ceiling for thrifts was just above what commercial banks were allowed to pay for the same types of accounts. The thrifts were thus given a fixed advantage. But the ultimate result of the controls was a huge outflow of money from the S&Ls to still other institutions, like money-market funds....Congress showed no inclination either to increase regulation of money-market funds or to let the thrifts meet the challenge by making adjustable-rate mortgages, whose interest rates could rise and fall competitively.

By the end of the 1970s the thrift industry was clearly obsolescent....The federal savings and loan insurance fund was even then greatly inadequate to the task of reimbursing depositors if the thrifts simply shut down.

In the early 1980s the government began trying to make its way across this economic minefield that it had assiduously laid for itself. First Congress lifted the thrifts' interest-rate ceilings. Since this change increased what thrifts would have to pay for deposits, large thrift institutions extracted a quid pro quo in the legislation: Federal deposit insurance was raised from $40,000 to $100,000 per account. Federal regulators instituted adjustable-rate mortgages and broadened the S&Ls' investment powers. The thrifts' capital requirements were eased considerably....

....At first the policies seemed to work: Deposits and capital started to flow into the thrifts. Federal regulators began to close down and sell troubled institutions. Soon, however, two of the policymaker's nightmares made their inexorable appearance. First, the law of unanticipated consequences took effect with a vengeance. Also, the disparate interests and ideologies behind the movement for thrift deregulation started pulling the project in contradictory directions.

As for unanticipated consequences, the effect of the $100,000 deposit guarantee, which made no distinctions between blue-chip institutions and breathtakingly risky operations, was disastrous....The combination of uncapped interest rates being offered by the S&Ls with the government's guarantee of absolute safety brought deposits flowing indiscriminately into conservative and high-risk thrifts alike....The hefty interest that the thrifts were obliged to pay on such deposits created great pressure to invest in risky high-yield enterprises.

....The atmosphere that began to pervade the thrift industry, smelling of big risks and big returns, began to attract high rollers and crooks. More important, even basically honest S&L managers, who greatly outnumbered the criminals, were often not well equipped to manage their institutions' money in the more complex and dangerous world that government policy changes had created. Losses in the industry mounted.

....Even with the continuing losses, the drop in interest rates in the mid-1980s gave the thrifts as a whole a nominal profit. It may be, as some of the earlier thrift regulators claim, that this was the time to move quickly to reorganize the industry, but no such thing happened. When the real estate market began to falter after the tax changes of 1986, whatever window of opportunity there might have been was closed, and the situation grew inexorably worse.

....[T]he original thrift deregulation strategy would surely have had a better chance if the federal regulators had operated with an enforcement staff well able to root out crooked practices and shady accounting. Yet for the administration's Office of Management and Budget, deregulation meant reducing the budgets of federal regulatory agencies. The budget office strongly resisted increases in the size or salaries of the enforcement staff, though by the mid-1980s the number and quality of supervisory personnel did start to rise.

More important, some deficit-conscious, constituent-sensitive top administration officials were happy to remove constraints on the S&Ls but unwilling to close down institutions that had failed. The policies of the early eighties had advocated selective forbearance for potentially healthy thrifts, but selective forbearance soon turned into a generally blind eye.

Richard T. Pratt, chairman of the Federal Home Loan Bank Board from 1981 to 1983, has said that in one shareholder lawsuit against the board for closing an insolvent thrift, a high Treasury Department official actually testified for the plaintiffs. When Pratt's successor, Edwin Gray, began asking for more enforcement staff and making new rules to restrict the activities of the worst thrifts, presidential chief of staff Donald Regan let Gray know that he wanted the chairman to resign before the end of his term. In late 1986 the White House helped feed a scandal in which Gray was shown to have accepted favors, primarily meals and hotel rooms, from the thrift industry he was regulating.

....Still, the Reagan administration cannot carry off the honors in the question of who was most enthusiastic about giving the S&Ls new freedom and least willing to permit the failure of thrifts that had misused that freedom. Well after the White House had started trying to deal with the worsening S&L crisis by means such as shoring up the deposit insurance fund so that failing thrifts could be closed and their depositors paid off, Congress blocked legislative action, in order to keep thrift institutions from being shut down and to give them a chance to make the final, desperate investments that might produce mountains of life-saving profits. Congressmen also used their power of the purse to try to get the regulators to go easy on individual S&Ls belonging to constituents and campaign contributors.

It may be remembered that in 1986, Rep. Jim Wright, then House majority leader, caused a major delay in the recapitalization bill for the insurance fund by putting a "hold" on it and used the threat of congressional inaction to try to get better bank board treatment of Texas S&L owners who were constituents and contributors. But Wright had a lot of company in his attitudes. To take one example, another congressman who delayed the insurance fund's recapitalization bill in 1986 was Senator David Pryor (D-Ark.), who held up the legislation more briefly while writing to Gray to complain about the board's "deliberate harassment" of Arkansas thrift institutions....Pryor was a member of the Senate ethics committee, which would soon be considering the cases of five other senators, some of whom had done not-dissimilar things on behalf of the S&L industry.

Indeed, perhaps Wright was lucky to get out of Washington when he did, for week by week the climate was turning harsher on the subject of Congress and the S&Ls. The Lincoln Savings and Loan Association of Irvine, California, became the symbol of this change of mind. Lincoln was purchased in 1984 by Charles H. Keating, Jr., who from the beginning of his tenure was at odds with federal regulators over how broad Lincoln's investment authority should be. In the spring of 1986 the conflict escalated as federal investigators began a detailed examination of Lincoln's affairs. A year later they were still investigating.

To plead his case and try to get the regulators off his back, Keating was able to mobilize, in various degrees, five senators (aka the Keating Five) to whom he had made a total of some $1.3 million in political contributions: Alan Cranston (D-Calif.), Dennis DeConcini (D-Ariz.), John Glenn (D-Ohio), John S. McCain (R-Ariz.), and Donald E. Riegle, Jr. (D-Mich.). Keating had put his money into these senators' campaigns and favorite causes.

Though their case has been contentious, the outline of its facts is fairly clear. In April 1987, with legislation pending to recapitalize the insurance fund, bank board chairman Gray was summoned to a meeting with four of the five lawmakers (there was later testimony that Riegle had arranged the meeting, but he did not attend) and told to bring no staff along. According to Gray's later accounts, the four senators wanted Gray and the bank board to withdraw a new regulation, being challenged in court by Keating, whose application limited Lincoln's ability to invest in undeveloped land. The senators also wanted to know why the regulators' examination of Lincoln was taking so long.

After this meeting, the San Francisco-based bank board staffers actually performing the examination of Lincoln were called to Washington to provide more specific information in a meeting with all five senators. The lawmakers again asked about delays in the investigation. They accompanied their speeches with some version of this disclaimer by Riegle: "If there are fundamental problems at Lincoln, okay" -- that is, go ahead and take action against it. Otherwise, the unspoken part of the message continued, get the investigation over with. After some discussion, one of the San Francisco examiners said, according to notes taken by a regulator there, "We're sending a criminal referral [of the Lincoln matter] to the Department of Justice." The notes show that the senators quickly subsided, though after the meeting, two of them -- Cranston and DeConcini -- kept trying to help Keating despite the regulators' mention of a possible criminal case against him.

As matters turned out, the senators probably did not have much effect on the timing of the bank board's actions against lincoln. But the case suffered great delays: It was another two years before Lincoln was finally taken over in the spring of 1989 amid charges that Keating had run reckless risks with the institution and milked it for himself and his family. When Lincoln was taken over by federal authorities, the bill to the taxpayer was estimated at $2.5 billion -- about twice the cost, said regulators, of closing the institution when they had first advocated it two years previously.

When news of the senators' meetings with bank board personnel emerged in May 1989, the S&L scandal shot into orbit. The Justice Department pledged a massive special effort to hunt down the crooks who had looted S&Ls. Congressmen rushed to ask department officials in stern tones why the enforcers were not hiring still more attorneys for the job. Campaign finance reform got a push forward in Congress. The Senate ethics committee started investigating the five senators involved in the Keating affair to determine which Senate rules they had violated.

Conventional scandal politics, in other words, became the first lens through which we viewed the crisis. As the S&L scandal burgeoned, press comment and official action focused heavily on the criminality of individual S&L operators and the evils of our campaign finance system, which was said to force congressmen into corrupt dealings with the unsavory likes of Charles Keating.

As for criminal S&L owners, they were surely and prominently in evidence. Some were massively crooked and colorful, and they made terrific copy.....Still, the most plausible evidence of how much of the S&L bill stemmed from out-and-out individual larceny ranges from 5 to 10 percent. The overwhelming majority of the losses stemmed from mere garden-variety cupidity or basic lack of shrewdness and brains.

....The size of the S&L scandal was monstrous not because there were thieves in the industry but because public policy had permitted the stakes to become so high. The strategy for saving the thrifts was a complicated one that needed constant adjustment and proceeded not so much by deregulating an industry as putting existing institutions into what was in many respects a new business. The regulators lacked control of some of the forces most important in determining their success or failure, from the $100,000 deposit guarantee to the actions of state legislatures. Finally, backers of thrift deregulation had a collection of inconsistent aims that guaranteed policy incoherence.

....Press coverage of the S&L issue certainly contributed to the skewed public attention. As the scandal finally broke open in 1989, the emerging evidence of the size of the crisis stimulated journalism reviews and press seminars to ask why American journalists had missed the importance of the S&L problem so completely....

In 1989 a newspaper in Dayton, Ohio, where Keating had ties, finally asked ex-chairman Gray about the story of the five senators and ran it on a slow news day. The Associated Press picked it up. Around the same time, congressional hearings featured testimony from elderly Californians who had lost money in the collapse of Lincoln. Journalists now saw that here -- in Charles Keating, the senators, and the old folks -- were the personalities and the personal scandal necessary to make the S&Ls a big story.

In November, safely after the 1990 elections, the Senate ethics committee began hearings on the senators associated with Charles Keating....[T]he Keating Five hearings were supervised by an extremely skilled special counsel, Robert S. Bennett, who was forced to deal with an issue that seemed to drive the committee, witnesses, and onlookers into...ambivalence.

On the one hand, Keating had given the five senators enough money so that they would have looked suspicious sending him a birthday card, let alone ganging up on a regulator and barring witnesses from the confrontation....On the other hand, the committee clearly had problems, feigned and real, in deciding just what their colleagues had done wrong....

Once the televised hearings opened, both press attention and the live coverage of the sessions by the Cable News Network produced a storm of public indignation. Yet some of the senators in the dock argued strenuously to the committee that their ethics were in fine shape. Their connections with Keating were legitimate constituent relationships, they said. Prestigious accountants had vouched for Keating's case against the bank board. As senators they were not only allowed but obliged to speak up for Keating....

Furthermore, as Senator Cranston and Senator DeConcini insisted in their opening statements, in helping Keating they were merely doing what all other senators did. Finally, there was no rule forbidding such practices....

The questioning of the witnesses by ethics committee members poked at this defense but raised no concerted challenge to it, and in its final actions, the committee bought the bulk of the defendants' arguments. Only Cranston, the committee ruled, would be placed before the full Senate for discipline; to the other four, the committee merely sent admonitory letters whose varying degrees of severity were distinguishable only to very careful readers.

....[T]he behavior on display in the Keating scandal was not really the product of today's high-cost political campaigns. We need look back only as far as the Gulf Oil scandal to be reminded that people with economic interests had figured out how to seek political advantage through large-scale political contributions even before the advent of PACs and 1980s-level campaign costs.

....Indeed, the problem of Congress's solicitude toward S&L owners was not even merely a problem of money in politics: The thrift institutions had their political clout not just because of their cash but because they were located in every congressional district in America. For decades the well-being of S&Ls had been closely tied to the general fortunes of the communities they served, and people had come to think of the two as nearly identical. Without these associations, the thrifts could have given just as much money to politicians with nowhere near so much effect.

Does this mean that the senators in the dock were right when they argued that they were scapegoats, on trial for actions that were ordinary, prevalent, and permissible under the rules? No. Cranston and DeConcini, the senators who had pushed most persistently for Keating, had not simply worked in the classic, unexceptionable way to get a hearing for a private interest. At a time when the dire state of the thrift industry was already widely known, they chose to give credence only to those experts who supported their constituent and contributor. They refused to doubt Keating even after the government had surely given them enough grounds for suspicion.

....Afterward it was said by critics that the Senate, which had been happy enough to embrace the idea of government ethics with enthusiastic sanctimony when it came to the executive branch, discovered prudence when the same political spirit came knocking at the congressional door....But the committee did not simply display prudence. Something worse had been revealed: Years of punitive legalism had left the ethics committee incapable of making the sorts of ethical judgments on which a political system truly depends.

Worse still, the enormous S&L scandal, more costly than all the rest of our 200 years of scandals added together, was an indictment of practices and habits deeply embedded in our national politics....

During these years, scandal politics made its way from the Hill to the White House and back again, but that was not the most important occurrence of the years between Watergate and the S&L scandal. More serious was that our frantic appetite to take hold of every scandal of intention harbored in the depths of national politics left us no time or energy to occupy ourselves with scandals, like that of the S&Ls and the recent BCCI crisis, involving more dangerous problems of competence and of political will. The same view of political life drives us repeatedly toward solutions that assuage the thirst for political cleanliness without taking much care for political performance.

|